No Articles Found

No articles are currently available.

A Memorandum of Understanding (MoU) is a crucial document that outlines the terms of a loan agreement, protecting both parties and ensuring clarity in the borrowing process.

This guide outlines the necessary documents for registering a Private Limited Company (Pvt Ltd), exploring benefits, challenges, and offering valuable insights for new entrepreneurs.

This article provides an in-depth look at AS 19 lease accounting standards, explaining the types of leases, their financial implications, and mandatory disclosures for accurate accounting practices.

Caveat petitions serve as a protective measure in legal disputes, ensuring your interests are safeguarded. Learn when and how to file one effectively.

No articles are currently available.

Incorporate your business with complete legal compliance and expert guidance.

Protect your brand identity with comprehensive trademark registration services.

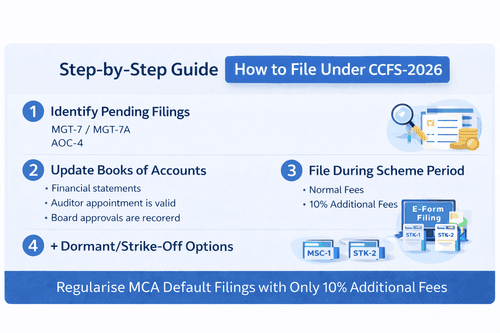

Learn how to file pending MCA returns under CCFS-2026 with 10% additional fees. Step-by-step process, eligibility, forms covered & deadlines.

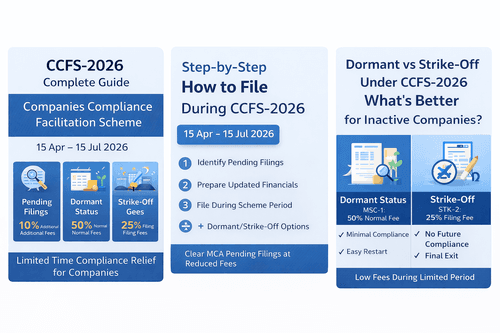

Learn CCFS-2026 applicability, benefits, fees (10% additional fee), eligible forms, exclusions, immunity and deadlines (15 Apr–15 Jul 2026).

The MCA has revised the definition of Small Companies under the Companies Act, expanding opportunities for private firms. Discover key changes, benefits, and implications.

Explore the essential techniques of storytelling that can enhance your ability to connect with others and convey your message effectively.